What would happen to your hard-earned assets in India if the unthinkable happened tomorrow?

For many NRIs, this is a question that often lingers at the back of the mind but is rarely addressed with the urgency it deserves. Without proper planning, your legacy could get locked in lengthy legal battles, slow-moving probate courts, and family disputes.

This guide is your roadmap to inheritance planning, ensuring that your wealth in India is protected and passed on seamlessly to your loved ones.

Why This is the Most Important Page You’ll Read About Your Indian Assets

Estate planning for NRIs goes far beyond just writing a will. In India, a proper beneficiary designation is the master key that allows your family to access funds without getting trapped in years of probate delays.

The reality is stark: without the right designations, your money and property may remain tied up in the courts, causing stress and hardship for your family. By proactively planning, you’re not only protecting your assets but also sparing your loved ones from avoidable disputes.

This is why inheritance planning should be at the top of every NRI’s financial checklist.

Beneficiary vs. Nominee: The Critical Indian Distinction Most NRIs Miss

One of the most misunderstood concepts in India is the difference between a beneficiary and a nominee.

- Nominee: A nominee is simply a custodian. They can claim the asset after your death, but they are required to hand it over to the legal heirs.

- Beneficiary: The actual person entitled to inherit the asset, usually as per a will or under the Indian Succession Act.

- Legal Heir: Determined either through a valid will or succession laws.

| Role | Rights in India | Final Ownership |

| Nominee | Custodian only | Must pass asset to heir |

| Beneficiary | Entitled party | Receives final ownership |

| Legal Heir | By will/law | Ultimate right to asset |

Understanding this distinction helps avoid one of the most common and costly NRI mistakes, assuming that naming a nominee is the same as naming a beneficiary.

What Are the Different Types of Beneficiaries for NRIs?

When filling out a beneficiary designation form, you’ll typically see four options. Here’s what each means:

| Beneficiary Type | Role & Function | Key Consideration for NRIs |

| Primary | First in line to receive the asset | Keep details updated |

| Contingent | Backup if primary cannot inherit | Always name one to avoid probate |

| Revocable | Can be changed anytime | Update after major life events |

| Irrevocable | Cannot be changed without consent | Used in trusts/legal settlements |

For NRIs, the most common choice is a revocable primary beneficiary, but naming contingent beneficiaries is equally important.

Navigating the Legal Maze: Key Rules for NRIs

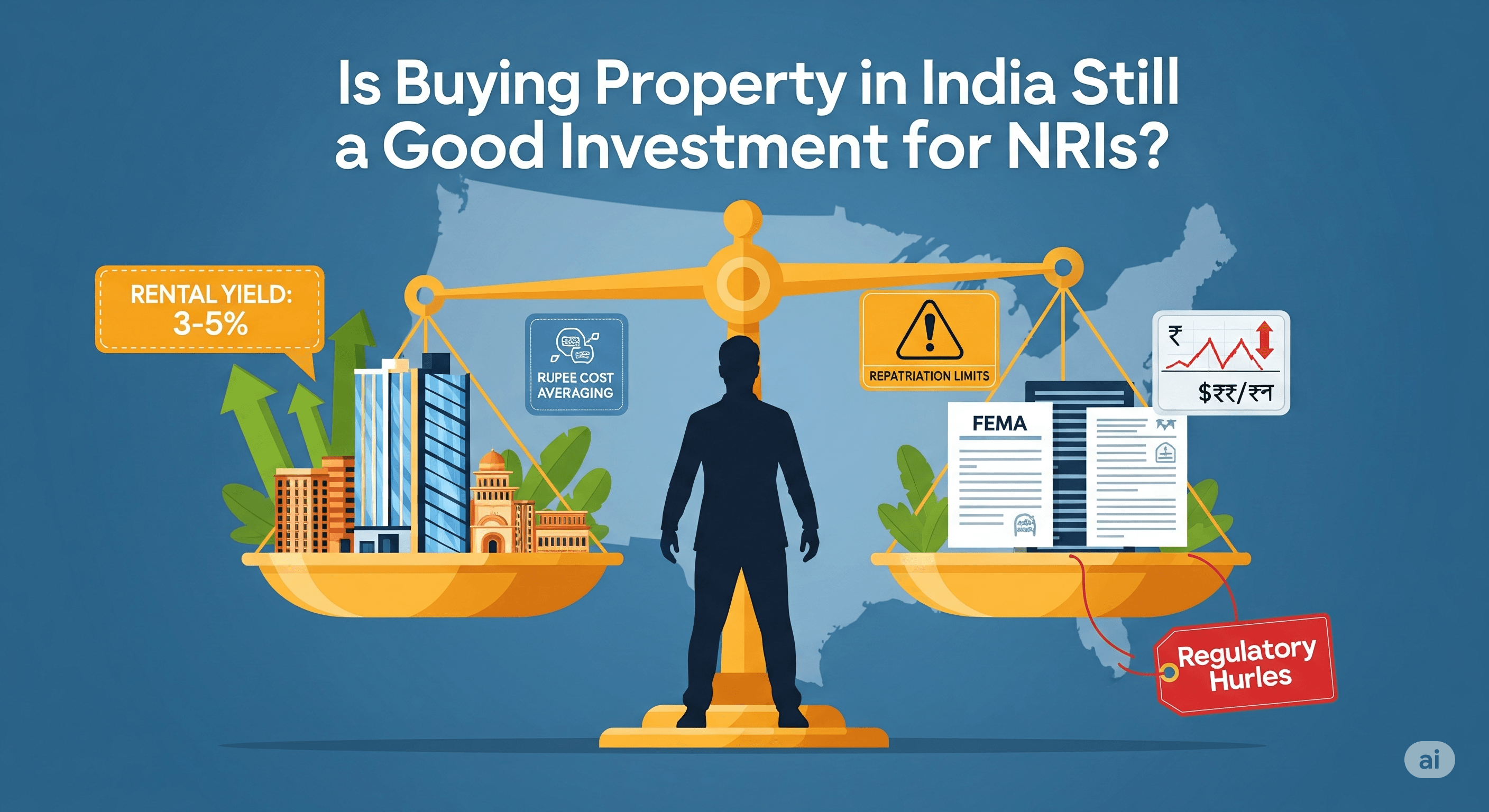

Inheritance for NRIs in India is governed by FEMA and RBI rules, which cover how assets can be held, transferred, and repatriated.

- Minor Beneficiaries: Assets may require a guardian until the minor comes of age.

- TDS on Property Sale: If a beneficiary inherits property and later sells it, TDS may apply at 20–30% depending on residency status.

- Repatriation Rules: FEMA allows up to $1 million per financial year to be repatriated abroad from an NRO account, subject to documentation.

Understanding these rules ensures compliance while preventing delays and penalties.

Your Step-by-Step Guide to Designating Beneficiaries

Here’s a clear roadmap every NRI should follow:

Step 1: Compile Your Asset Inventory

Make a list of all assets: property, bank accounts, fixed deposits, NPS/PF, mutual funds, and insurance. (Use an asset inventory checklist for accuracy.)

Step 2: Choose the Right Beneficiaries

Select primary and contingent beneficiaries carefully, ensuring they are legally recognized and updated.

Step 3: Be Hyper-Specific in Documentation

Use full legal names and ID numbers, avoid vague designations like “my children.”

Step 4: Plan for Special Cases

For minors or dependents with special needs, consider setting up a trust or guardian arrangement.

The 5 Most Costly Beneficiary Mistakes NRIs Make (And How to Fix Them)

- The “Set It and Forget It” Trap – Failing to update after marriage, divorce, or births.

- The “Vague Designation” Disaster – Using unclear terms like “family.”

- The “Nominee is Owner” Myth – Mistaking nominee rights for final ownership.

- The “Digital Blindspot” – Forgetting to include Demat, digital wallets, and online assets.

- The “Tax Ignorance” Penalty – Overlooking TDS and capital gains taxes.

👉 Pro Tip: Regularly review your designations to avoid probate issues in India.

Understanding Your Transaction: Joint Accounts & Cancellations

- Joint Accounts: You can only use them if you are a registered account holder.

- Cancellations: Transactions can be canceled within 30 minutes for corrections.

- Repatriation: Remember FEMA’s $1M annual repatriation limit.

The Beneficiary’s Journey: A Guide from Claim to Repatriation

Step 1: The Claim Process

Heirs must submit claim forms, ID proof, death certificate, and beneficiary designation forms.

Step 2: Navigating Indian Taxes

TDS on property sales, inheritance exemptions, and succession laws apply.

Step 3: Repatriating Funds

Funds must flow through an NRO account, with Form 15CA/15CB filed for compliance.

Step 4: Common Transactional Questions

✔️ Joint accounts only if you’re listed.

✔️ Cancel within 30 minutes if needed.

Conclusion

Beneficiary planning may feel complicated, but it’s the single most important step NRIs can take to protect their Indian assets.

✅ Compile assets

✅ Name specific beneficiaries

✅ Understand FEMA & tax rules

✅ Avoid the common mistakes

With proactive planning, you can give your family clarity and security, ensuring your hard-earned legacy is protected.

👉 Start today by reviewing your beneficiary designations.

FAQs

Q1. Can I use my will from the USA for my Indian property?

Usually no. Indian property is governed by NRI inheritance law India, requiring compliance with local succession laws.

Q2. What happens if an NRI dies without a will in India?

The estate is divided based on dying intestate in India under the Indian Succession Act.

Q3. How can a beneficiary in the USA sell an inherited property in India?

By transferring ownership, paying applicable TDS, and using FEMA’s rules for repatriation.

Q4. Is inheritance from parents in India taxable for an NRI living in Canada?

Inheritance itself is tax-free, but subsequent income or sale is taxable.

Q5. Can a trust be a beneficiary in India?

Yes, trusts are often used to manage assets for minors or dependents