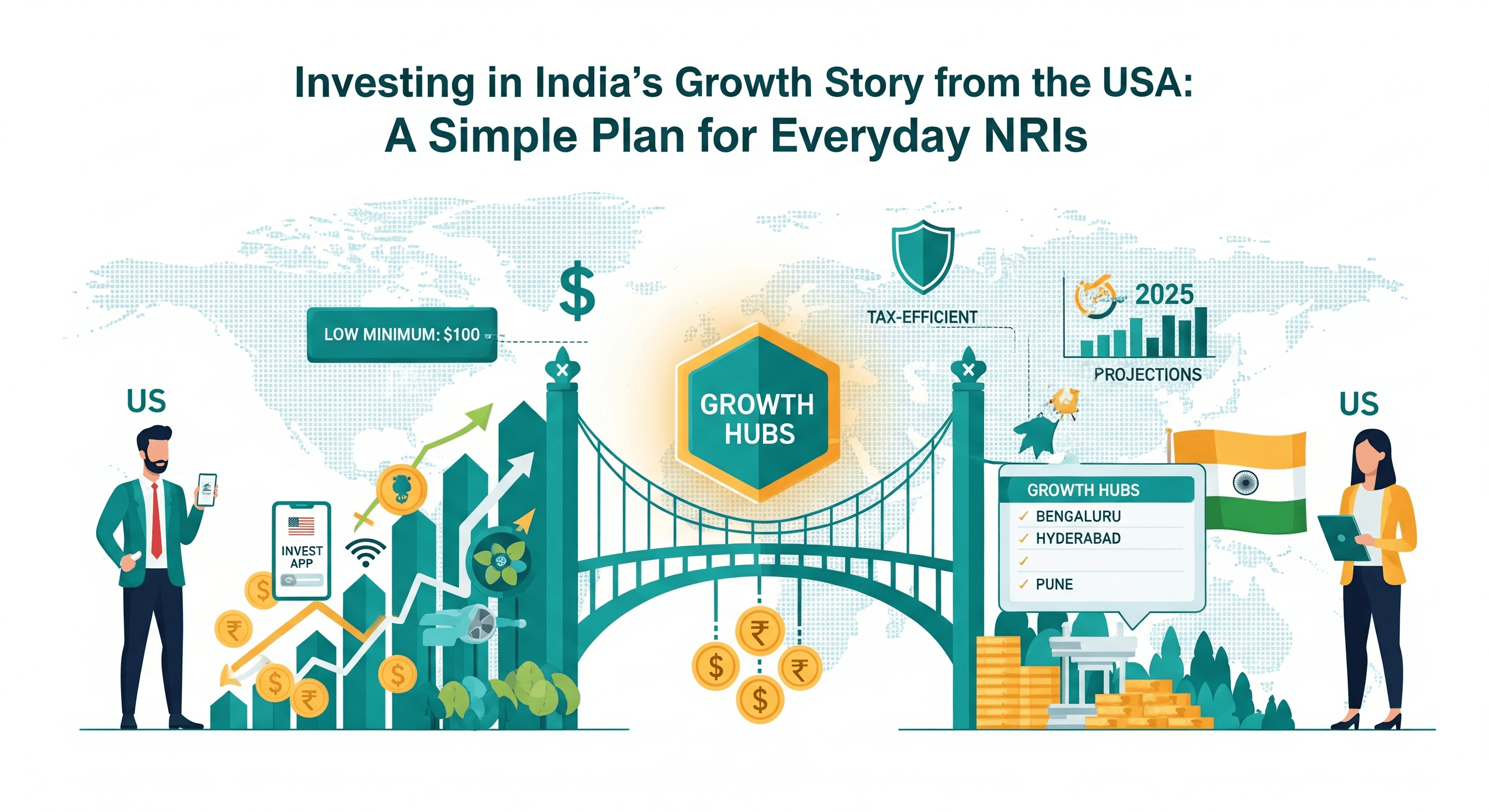

India is one of the world’s fastest-growing major economies, a true global growth story. As an NRI in the USA, you’re in a unique position not just to watch this story unfold but to participate and build your own wealth in the process.

But for many, the idea of investing in India from abroad seems complex filled with confusing acronyms, paperwork, and uncertainty. Where do you even begin?

The good news: it’s easier than ever for an “everyday NRI” to start. The simplest path is to send money into an NRE account and invest systematically in Indian Mutual Funds via a Systematic Investment Plan (SIP).

This guide breaks the process down into simple, practical steps so you can confidently invest in India’s future right from your home in the US.

Why Should You, an NRI, Invest in India? The 2025 Opportunity

High Growth Potential

India’s GDP is projected to grow at 6.5–7% in 2025 (World Bank). With a rapidly expanding middle class and digital-first economy, sectors like fintech, IT, and consumer goods are set for long-term growth.

Currency Benefit

As an NRI, you earn in USD, a strong, stable currency and invest in India, where returns often outpace inflation and global averages. This combination gives you a compounding edge.

Portfolio Diversification

By investing in India, you reduce overexposure to only US assets, balancing your portfolio with high-growth emerging markets.

Building Assets Back Home

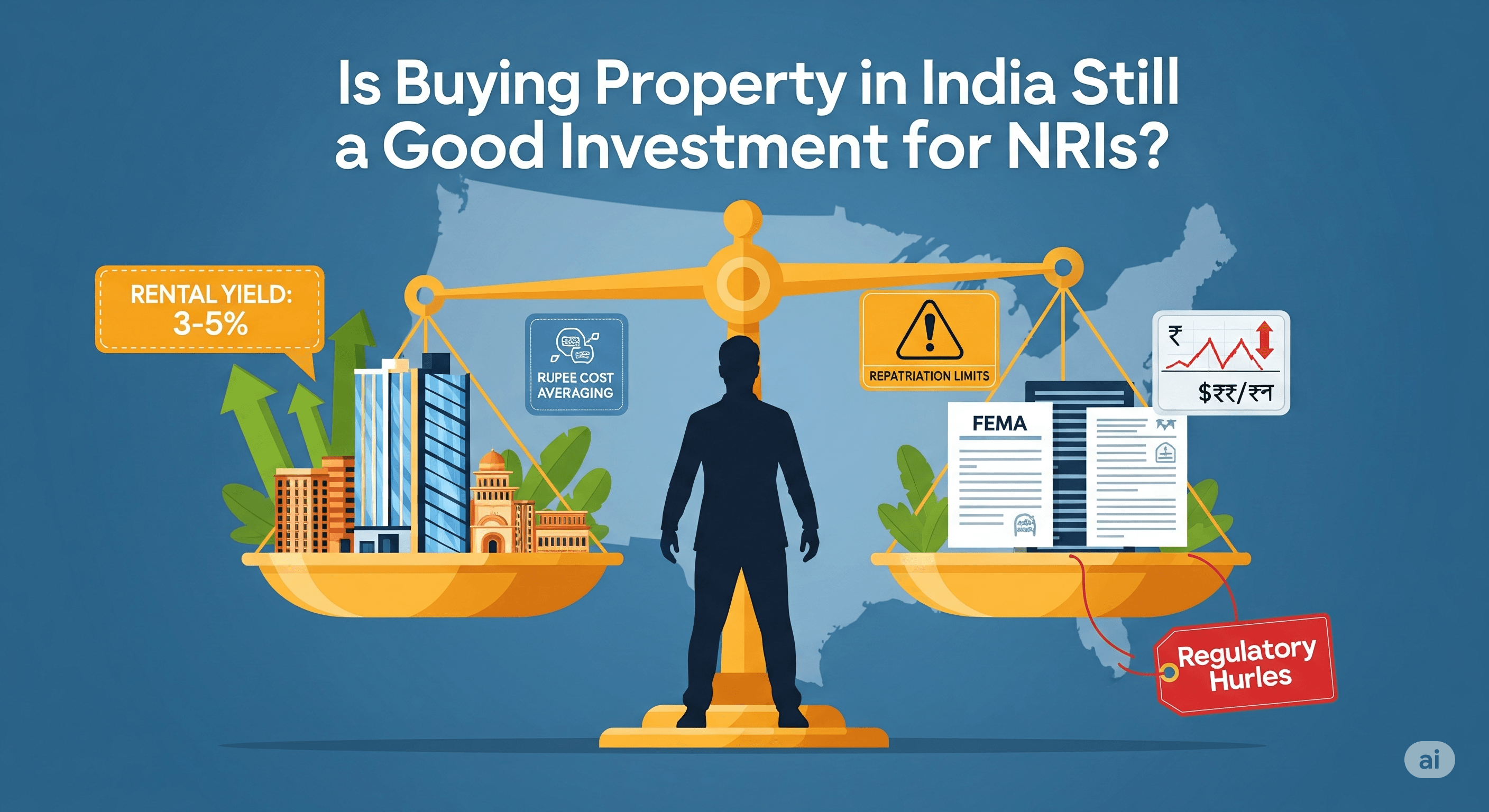

Investments in India whether mutual funds, stocks, or property create a solid financial foundation in your home country, useful for future goals like retirement, family support, or relocation.

The Building Blocks: Your Essential NRI Investment Accounts

Before you invest, you need the right accounts. Here’s what matters most:

1. NRE/NRO Bank Accounts

- NRE (Non-Resident External) Account:

Best for foreign earnings. Both the principal and interest are fully repatriable (you can send them back to the USA). Interest earned is tax-free in India, making this the recommended account for investments. - NRO (Non-Resident Ordinary) Account:

Used for Indian income (like rent, pension, or old savings). Interest is taxable in India and repatriation is limited.

Key Insight: For fresh US earnings being invested in India, always use an NRE account.

2. Demat & Trading Accounts

- Demat Account: A digital locker that securely stores your shares and mutual fund units.

- Trading Account: The tool you use to buy and sell those shares or funds.

Today, most leading brokers (e.g., ICICI Direct, HDFC Securities, Zerodha) offer 2-in-1 or 3-in-1 accounts (Bank + Demat + Trading) to make life simpler for NRIs.

Your Simple 4-Step Plan to Start Investing from the USA

Step 1: Open Your NRE Bank Account

This is the foundation. Major Indian banks allow NRIs to open NRE accounts digitally from the USA. You’ll typically need:

- Passport & Visa copy

- US address proof

- Indian address proof (optional)

- Photograph

Step 2: Choose an Investment Platform & Complete Your KYC

Pick an NRI-friendly broker like Groww, Zerodha, ICICI Direct, or Kotak Securities.

- KYC (Know Your Customer) is mandatory.

- Documents needed:

- PAN card (mandatory for investments)

- US address proof

- Passport & visa copy

- Photograph

- Many brokers now allow video KYC, making the process quick.

Step 3: Fund Your Investments with Abound

Once your NRE account is ready, you need to move money into it. This is where Abound makes a difference.

With Abound, you can:

- Transfer directly from your US bank account to your NRE account.

- Get transparent exchange rates and zero hidden fees.

- Enjoy secure, same-day transfers with full tracking.

This ensures your money is ready to invest without unnecessary delays or costs.

Step 4: Choose Your Investment & Start Small

Now comes the exciting part: deciding where to invest. Start small ₹5,000–₹10,000 per month and scale gradually as you get comfortable.

What to Invest In? The 3 Simplest Options for Beginners

| Investment Option | Effort Level | Risk Level | Best For |

| Mutual Fund SIP (Recommended) | Low (Set & Forget) | Medium | Everyday NRI who wants disciplined, long-term growth |

| Direct Stocks | High (Requires Research) | High | Hands-on investor who enjoys stock picking |

| US-Listed India ETFs | Low | Medium | NRI who wants India exposure via US brokerage accounts |

Option 1 (Recommended): Mutual Funds via SIP

- What it is: Professionally managed basket of stocks.

- What is an SIP?: An automated plan to invest a fixed amount every month. Think of it like a recurring “bill” for your future wealth.

- Why it works for NRIs: Discipline + automation + rupee cost averaging. A “set it and forget it” strategy.

Option 2: Direct Stocks (Equities)

- Buy individual companies like Reliance, TCS, HDFC Bank.

- High-risk, high-reward. Suitable only if you have the time and expertise.

Option 3: India-Focused ETFs in the USA

- ETFs like INDA (iShares MSCI India ETF) listed on US exchanges.

- Easy to buy through US brokerages (Fidelity, Charles Schwab).

- Limited options and different US tax implications.

Conclusion: You Don’t Need to Be an Expert to Start

Investing in India’s growth story from the USA is no longer reserved for financial elites. With the right accounts, simple tools like SIPs, and reliable money transfers, any NRI can build wealth in India while living abroad.

Remember: Start small, stay consistent, and let India’s growth work for you.

Your first step? Fund your NRE account.

With Abound, you can transfer money seamlessly, giving you the foundation to begin your investment journey today.

Get Started with Abound Now

FAQs

Why should NRIs invest in India?

India offers high growth, portfolio diversification, and the chance to build assets back home.

What is the simplest way for NRIs to invest?

Open an NRE account, send money via a service like Abound, and start a Mutual Fund SIP.

Do I need a PAN card to invest?

Yes, a PAN card is mandatory for any investments in India.

What’s better for NRIs—NRE or NRO account?

Use an NRE account for foreign earnings (repatriable & tax-free interest). Use an NRO account only for Indian income like rent.

Can I invest in India without opening Indian accounts?

Yes—through India-focused ETFs available on US exchanges, but options are limited compared to investing directly in India.