For many Indian NRIs in the USA, the dream of owning a home back in India is a powerful one. It’s more than bricks and mortar—it’s a connection to roots, a base for family visits, and a cornerstone of a financial legacy.

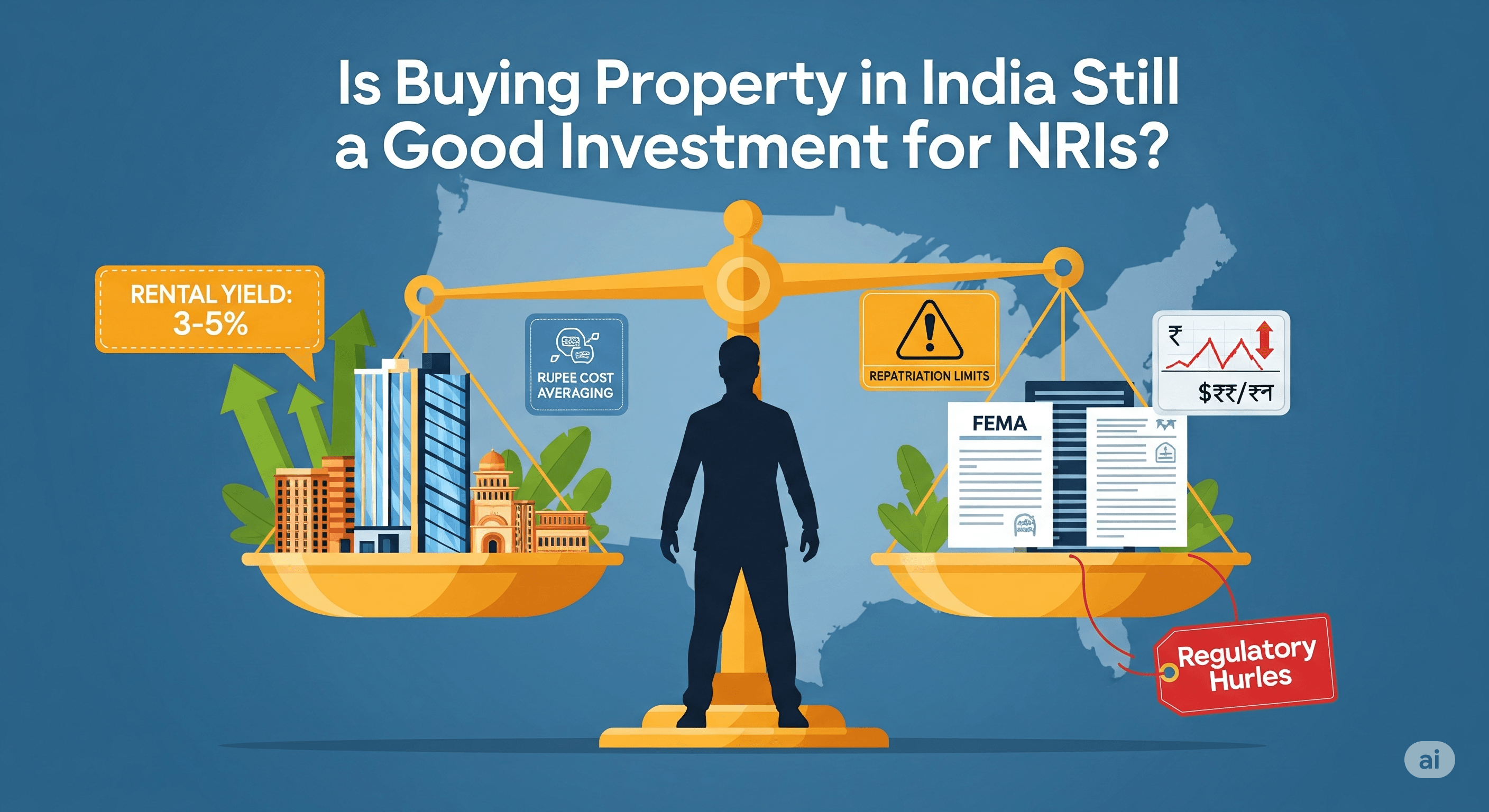

But in the dynamic Indian real estate market of 2025, this emotional dream must be weighed against a critical question: Is it still a smart financial investment?

The answer is nuanced. Indian property can still deliver significant rewards but the days of guaranteed, skyrocketing returns are gone. A successful NRI investment in 2025 requires clear goals, due diligence, and risk awareness. This guide provides a balanced roadmap to help you make the right call.

The Big Picture: Pros vs. Cons of Investing in Indian Real Estate (2025 Snapshot)

Here’s a quick comparison table that captures both sides of the debate:

Pros | Cons |

| Emotional & cultural anchor for family and legacy | Low liquidity – difficult to sell quickly |

| Potential for long-term appreciation in growth corridors | Tenant & property management headaches from abroad |

| Rental income in INR provides steady cash flow | Legal hurdles with title deeds, encumbrance checks, RERA compliance |

| Tangible retirement asset in India | Market volatility – prices can stagnate or decline |

| Portfolio diversification beyond US equities | Currency fluctuation risk (USD/INR impacts returns) |

The Pros: Why It Can Be a Great Decision

- Emotional & Cultural Anchor: A base in India for visits or eventual return.

- Long-Term Growth Potential: Well-located properties in developing cities can appreciate over 5–10 years.

- Rental Income Stream: Generate passive cash flow in INR.

- Retirement Security: A home to live in during your golden years.

- Diversification: Reduces reliance on purely US assets.

The Cons: The Risks Every NRI Must Consider

- Liquidity Challenges: Selling property can take months.

- Management Issues: Handling tenants, repairs, and disputes remotely is stressful.

- Legal/Bureaucratic Complexity: Title, encumbrance, and registration paperwork require vigilance.

- Market Volatility: Not all Indian cities guarantee appreciation.

- Currency Risk: INR depreciation can erode your returns when converted back to USD.

The NRI Rulebook: Legal & Financial Must-Knows

What Type of Property Can You Legally Buy?

- ✅ Allowed: Any number of residential or commercial properties.

- ❌ Not Allowed: Agricultural land, farmhouses, or plantations.

How Can You Fund Your Property Purchase?

- Remittance from the USA: Send foreign earnings to India via normal banking channels.

- NRE/NRO Accounts: Use funds already parked in your NRE (repatriable) or NRO (non-repatriable) accounts.

- Home Loans from Indian Banks: NRIs are eligible, but need:

- PAN card

- Employment/Income proof

- Valid visa & passport

- Overseas address proof

Your Step-by-Step Action Plan for Buying Property from the USA

- Define Your ‘Why’

Is it for parents, retirement, or rental yield? Your purpose determines city, size, and budget. - Budget & Financing

- Decide cash vs. loan.

- Get loan pre-approval if considering a bank loan.

- Assemble Your Team

- Real estate agent (local, reputed).

- Lawyer (specializing in property).

- Extreme Due Diligence

- Clear Title Deed (no disputes).

- Encumbrance Certificate (no pending loans).

- RERA Registration for new projects.

- Execute a Power of Attorney (PoA)

- Appoint a trusted relative/professional in India to handle documentation.

- Sale Agreement & Registration

- Sign agreement → Pay stamp duty & registration → Property legally in your name.

The 2025 Market Snapshot: Key Trends to Watch

1. Rise of Tier-2 Cities

Cities like Pune, Hyderabad, Ahmedabad, and Coimbatore are attracting investors due to lower costs, IT parks, and infrastructure growth.

2. Demand for Gated Communities

Post-pandemic buyers prefer secure, amenity-rich complexes with open spaces, gyms, and 24/7 security.

3. Impact of Interest Rates

RBI’s stance on interest rates in 2025 is keeping home loan EMIs relatively stable, sustaining demand but moderating speculative price hikes.

Conclusion: Is the Dream a Smart Move for You?

The dream of owning a home in India is still alive for NRIs in 2025 but it’s no longer a “buy anything, make a fortune” game. Instead, it’s a strategic decision that blends personal emotion with financial prudence.

Today, property in India should be seen less as a quick-profit bet and more as a long-term anchor—your family’s base, your retirement nest, and a tangible tie to home.

👉 Your success will depend on rigorous due diligence, trusted local partners, and aligning the investment with your personal and financial goals.