India remains one of the world’s most attractive investment destinations—thanks to strong GDP growth, a booming middle class, and rising digital adoption. For NRIs in the US, investing back home isn’t just financially rewarding, it’s also a way to stay connected to roots.

But here’s the catch: cross-border investing comes with unique pitfalls. Unlike domestic investors, NRIs must navigate two tax systems, special regulations, and compliance hurdles. Missteps can lead to penalties, liquidity problems, or even frozen accounts.

This guide uncovers the most common NRI investment traps, and shows you how to sidestep them to protect your hard-earned capital.

The Most Common NRI Investment Traps to Avoid

1. Ignoring the IRS (The FATCA & FBAR Landmine)

What Not to Do: Don’t assume your Indian investments are invisible to the US government.

Why It’s a Trap:

- The US requires NRIs to report foreign assets under FATCA (Form 8938) and FBAR (FinCEN Form 114).

- Penalties for non-disclosure can run into tens of thousands of dollars per violation.

- Even a small Indian bank account must be reported if the aggregate value of your foreign assets exceeds $10,000 at any point during the year.

👉 Rule of thumb: Always disclose. Silence is more expensive than tax.

2. Using the Wrong Bank Account (The NRE vs. NRO Mix-up)

What Not to Do: Don’t route your US earnings into an NRO account if you want easy repatriation.

Why It’s a Trap:

- NRO accounts are meant for income earned in India (rent, dividends, etc.).

- Funds repatriation from NRO requires Form 15CA/CB certification, attracts TDS, and involves paperwork.

- By contrast, NRE accounts are designed for foreign income: funds are fully repatriable and interest is tax-free in India.

👉 Always segregate: NRE = foreign income | NRO = Indian income.

3. Investing in “Forbidden” Products

What Not to Do: Don’t invest in schemes not permitted for NRIs.

Why It’s a Trap: Certain Indian instruments are off-limits to NRIs, especially those from the US.

- ❌ Public Provident Fund (PPF)

- ❌ National Savings Certificate (NSC)

- ❌ Sukanya Samriddhi Yojana

Holding such products can lead to account closure and penalties.

4. Choosing a Non-Compliant Mutual Fund House

What Not to Do: Don’t invest without confirming if the Asset Management Company (AMC) accepts US-based NRIs.

Why It’s a Trap:

- Due to FATCA, many Indian AMCs restrict investments from US residents.

- If you invest without checking, your account could later be frozen, or you may be forced to redeem at a loss.

👉 Always ask the AMC: Do you accept US NRIs under FATCA compliance?

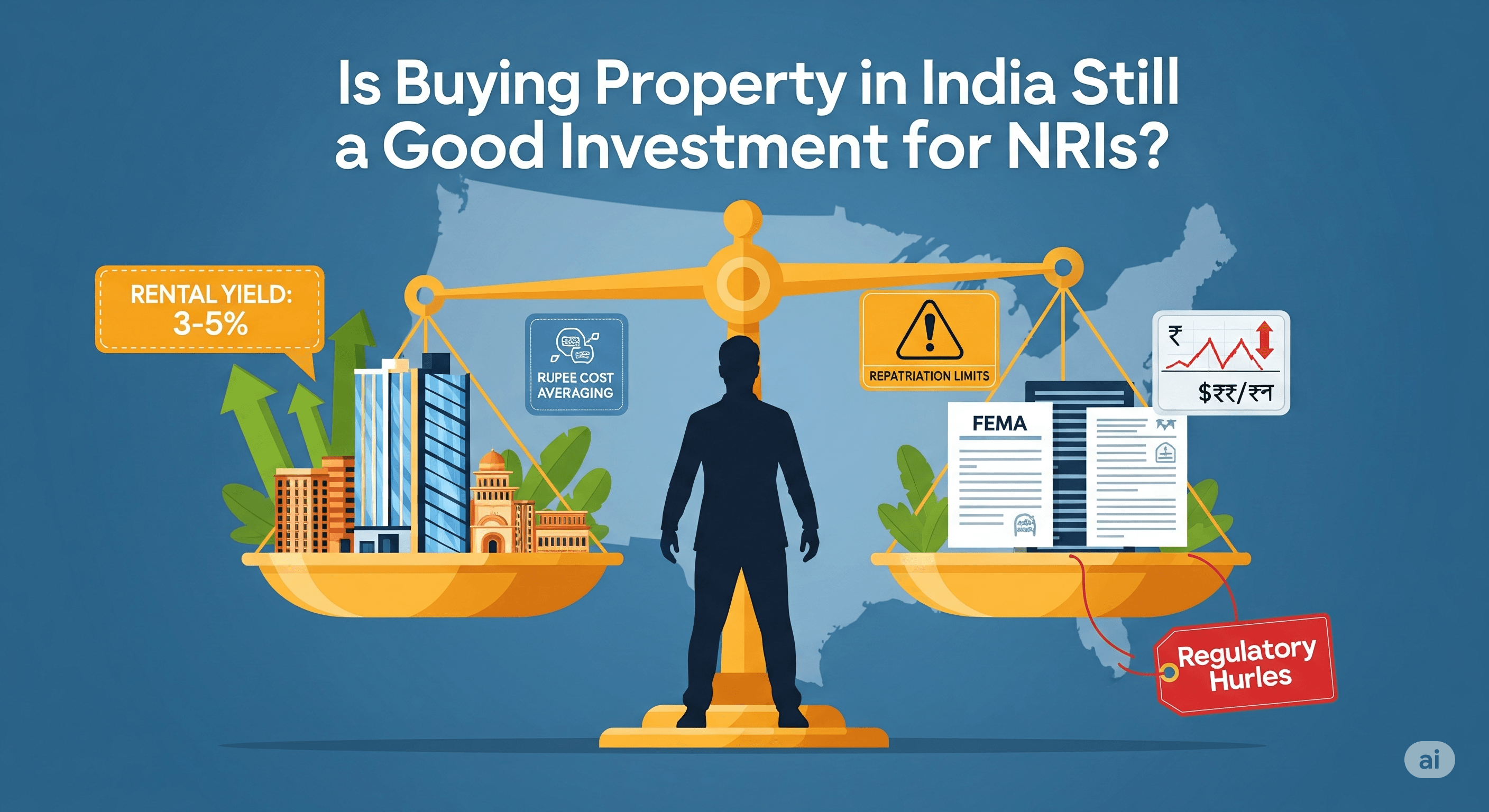

5. Putting All Your Eggs in the Real Estate Basket

What Not to Do: Don’t concentrate only on property.

Why It’s a Trap:

- Real estate is illiquid and expensive to manage from abroad.

- Transaction costs (stamp duty, brokerage, registration) can eat into returns.

- Rental management can turn into a long-distance headache.

Balanced portfolios that include financial assets (equities, FDs, mutual funds) offer diversification, liquidity, and peace of mind.

6. Falling for Unsolicited “Hot Tips” from Friends and Family

What Not to Do: Don’t invest in anything that comes via WhatsApp forwards or “guaranteed” advice from relatives.

Why It’s a Trap:

- High-return promises = high risk or fraud.

- NRIs are common targets for scams because they can’t verify ground realities.

👉 Rely on licensed advisors or do your own due diligence.

7. Forgetting About Taxes (In BOTH Countries)

What Not to Do: Don’t invest without mapping out the tax implications in both India and the US.

Why It’s a Trap:

- India applies TDS on NRO interest, dividends, and capital gains.

- The US taxes global income, including Indian investments.

- Without planning, your returns can be cut down in both countries.

👉 Use the India–US Double Taxation Avoidance Agreement (DTAA) to claim credits and avoid double tax.

8. Underestimating Currency Risk (The USD vs. INR Fluctuation)

What Not to Do: Don’t assume a 15% INR return translates to 15% in USD.

Why It’s a Trap:

- If the Rupee depreciates against the Dollar, your effective return shrinks.

- Example: A ₹15 lakh return may look strong in India—but if INR drops, you may end up with far less in USD terms.

Currency risk is invisible but powerful—always account for it.

So, What SHOULD You Do? The Safe Investor’s Checklist

To flip the script, here’s a quick list of smart practices:

- [✓] Always Disclose: File FATCA & FBAR on time.

- [✓] Segregate Funds: NRE for foreign money, NRO for Indian earnings.

- [✓] Stick to Permitted Products: Equities, compliant mutual funds, NRE/NRO FDs.

- [✓] Diversify Wisely: Mix real estate and financial assets.

- [✓] Seek Professional Advice: Hire a fee-only financial planner and a cross-border CPA.

Conclusion:

Investing in India from the US is rewarding—but only if you play by the rules. The traps we covered—from ignoring FATCA to falling for “hot tips”—are avoidable with awareness and discipline.

The best step you can take? Consult with qualified professionals who understand both Indian and US systems. With the right strategy, you’ll not only avoid costly mistakes but also invest with confidence in India’s growth story.